To Fee, or Not To Fee?

In a space where wild headlines are the status quo, the digital asset newsfeed in recent weeks has been particularly juicy. Regulatory actions in the U.S. have reached the largest players while some of the most influential brands and storied financial institutions continue rolling out new ways to interact with clients on-chain. It’s easy to be distracted by the flashier announcements, but beneath the surface, there were some nuanced developments. In particular, the debates surrounding whether some of the largest DeFi protocols should return capital to their token holders have piqued my interest.

The decentralized exchange (DEX), Uniswap (Uni) and its governance token $UNI, figure prominently in these debates. The token enables holders to vote on protocol management, and it currently carries a market capitalization of $4.7B USD.

Market Capitalization (in billions, USD)

Why does the market assign a multi-billion-dollar value to the governance of the Uniswap DEX protocol? The Uniswap V2 smart contract has a variable, feeTo, which can be configured to send a portion of transaction levies to a chosen address, rather than paying the entire amount to liquidity providers (LPs). The Uni DAO could move to send the accrued fees to its treasury wallet. In fact, there have been several proposals to this effect, the most recent coming from GFX Labs. A principal motivation for owning $UNI has been the notion that, in time, the “fee switch” would be enabled and some of the protocol’s revenues could be shared with tokenholders.

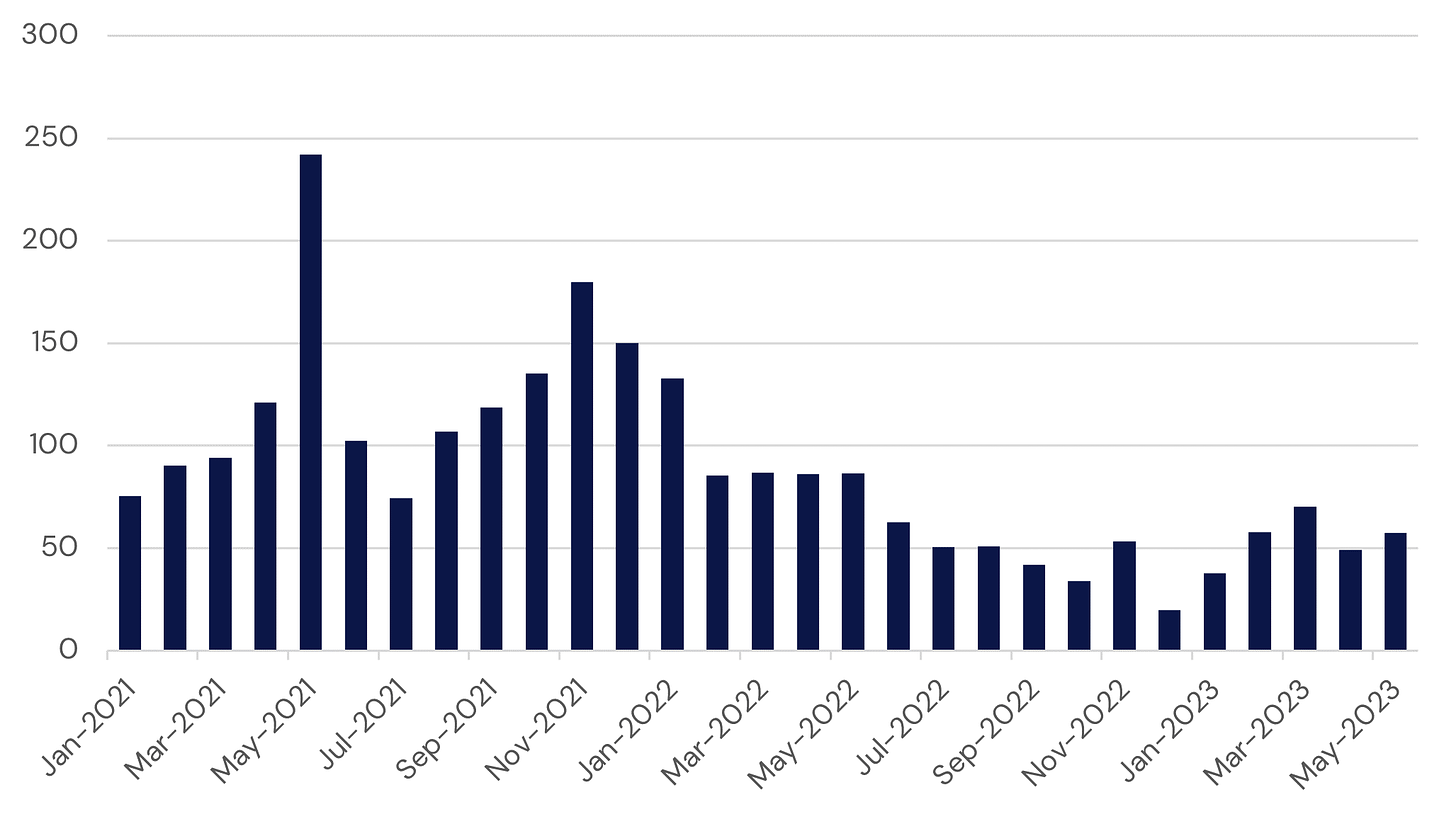

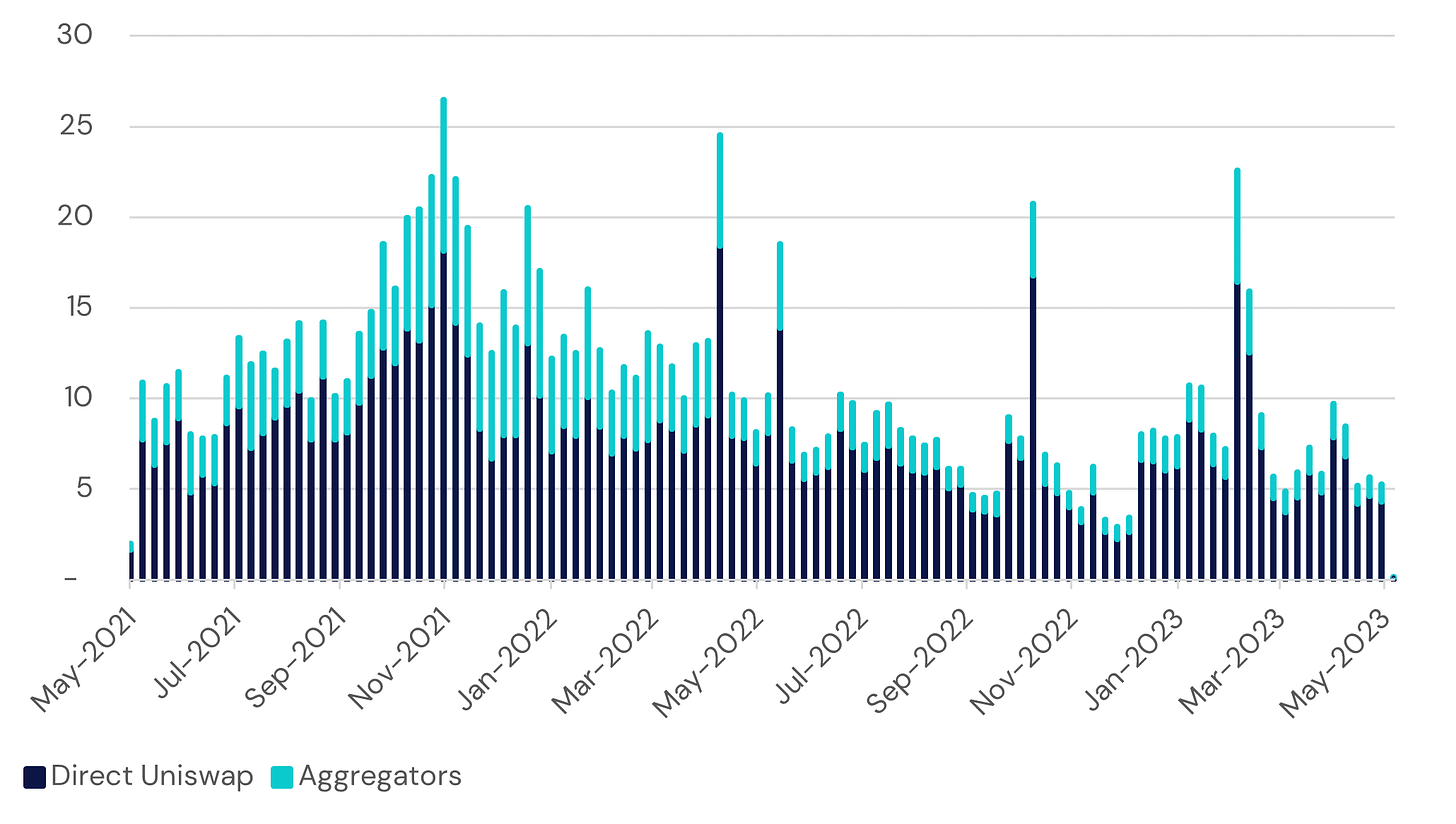

Before we get into some of the more technical issues for implementing the fee switch, let’s put the conversation in perspective of Uniswap’s earning potential.

Uniswap Monthly Fees Since 2021 (in millions, USD)

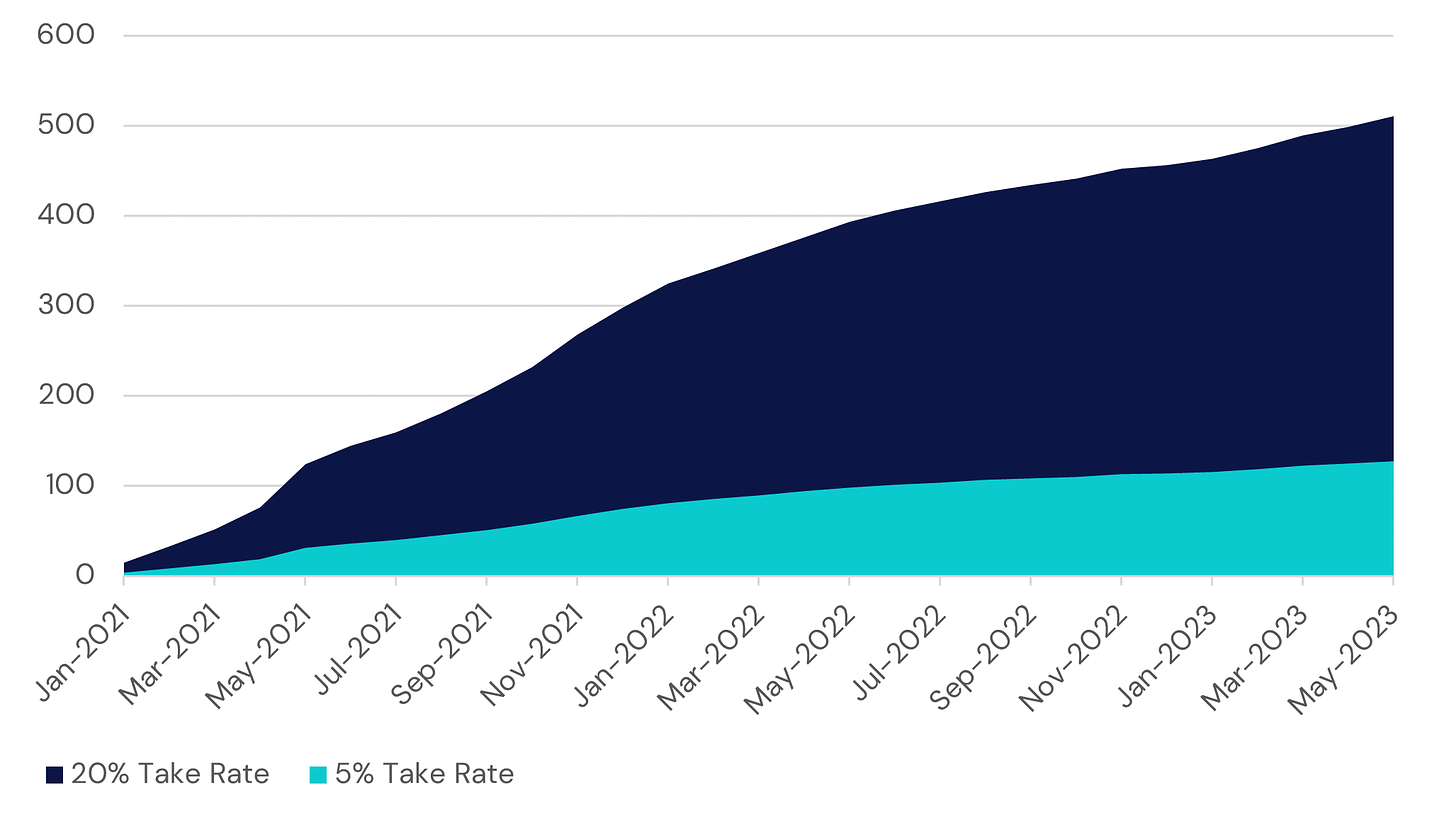

All things equal, had the DAO accrued 5% - 20% of the LP commissions, the additional capital available to the DAO/tokenholders would be $128M - $510M. These are considerable revenues relative to the current treasury value of $2B. Critically, this hypothetical balance would have accrued over a period during which digital assets remained far from mass adoption. The potential sums of excess capital are no way trivial, and the size of the prize underscores the importance of being thoughtful when debating if the Uniswap DAO should claim a fee and if so, what they should do with it.

Revenue Potential for Uniswap DAO and/or $UNI holders

Implementing the fee switch presents many hurdles. Proposals are needed for each action, and implementing the fee switch across all pools would take years under the current voting process. A potential solution would be to start with a small pilot program before extending the fee switch to other pools (as GFX suggested). However, DAOs, while transparent and inclusive, are still in their infancy and inefficient.

The question arises whether it makes sense to entrust the management of an even larger portfolio to tokenholders. Diversifying the treasury to include uncorrelated assets like stablecoins would enhance the DAO's sustainability, but the current governance structure is not suited to allocating capital at scale.

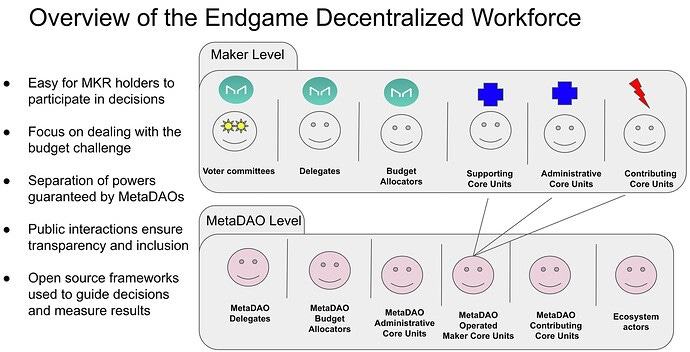

MakerDAO is another DeFi primitive that encountered similar issues recently and the proposed solution involves the establishment of six sub-DAOs, AI tooling, voting incentives, and finally some sort of governance sidechain. The decentralized operation of sizeable organizations is seriously complicated.

Perhaps a logical solution would be to pass the fees directly to token holders? Unfortunately, this would further complicate an already murky tax and legal treatment of revenues at the DAO level, let alone the trying to get clarity from the various jurisdictions of each $UNI holder. The SEC has recently alleged that over 60 tokens are unregistered securities, and I’m no lawyer, but I suspect their case would be stronger if the holders of those assets received regular disbursements tied to revenues from the underlying technology. The situation in Europe and the U.K. is similar. Given the complexity of coding and overseeing developments like the fee switch, Uniswap and others should first consider the regulatory climate when deciding to enable revenue sharing models.

Funneling trade levies to token holders might invite competition. Uniswap has entrenched itself as a fundamental piece of DeFi infrastructure, but many of its key attributes are available to rivals as well. Uniswap's open-source V2 and V3 can be easily forked. Taking even a nominal percentage of trading commissions away from LPs might incite a similar Vampire attack to what Sushiswap attempted in 2020. Uni has done an admirable job of maintaining market share in a competitive space. Even amidst innovations that provide smart order routing across DEXs, there’s still an overwhelming percentage of users who choose to interact with the protocol directly.

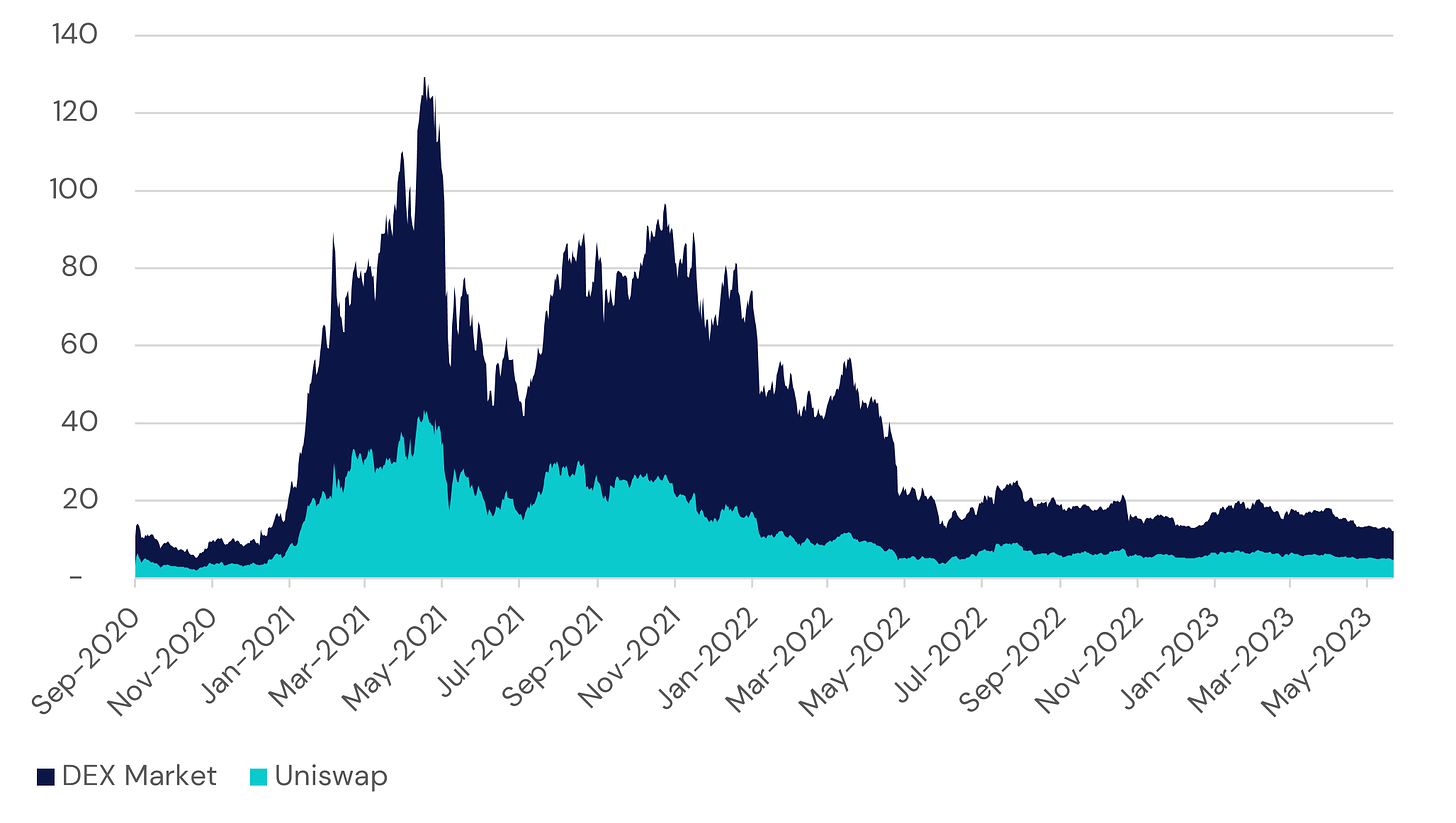

Uniswap Trading Volume (in billions, USD)

Engaging regularly with all stakeholders and providing innovative solutions to their pain points is critical to maintain the moat-like components of network effects, so the DAO might be well-served to preserve some of the accrued fees if this functionality was enabled. If you’re getting #REF! error while reading the preceding sentence in the context of extreme complexity allocating capital and managing operations at scale as a of decentralized group, then I’m with you. But, similar to how we deal with circular arguments in Excel, a thoughtful and iterative approach to modeling the situation can result in an elegant solution. Alternatively, better tech can also help…

Capital allocation and shareholder returns are critical assessments when evaluating the merits of traditional equity ownership. I get that many observers of digital assets aren’t focused on the intricacies of operating decentralized protocols. It’s more like, “When will the price go up?” However, reading through the GFX proposal and the comments that followed, I was reminded of how early we are in the journey of representing financial primitives on blockchains with little-to-no centralized oversight.

If a company wants to issue a dividend to common shareholders or introduce a stock repurchase program, then it’s as easy as getting Board approval, appointing some intermediaries, and sending wire transfers. In crypto, we’re not even sure if such an action is legal, let alone how best to engineer a suitable solution or how to manage capital allocation decisions. Eliminating intermediaries has the potential to unlock considerable efficiencies, but there’s a lot of work to do before we’ll be anywhere near such a reality.

At Aquanow, we help institutions unlock the potential of digital assets, so if you or anyone you know are considering this functionality, then please get in touch. We’d be glad to leverage our expertise to help you outperform.

If you want to contribute to the web3 movement, Aquanow is on the look for curious and motivated folks to join our team. Feel free to reach out directly or check out the current openings here.