Spot the Difference

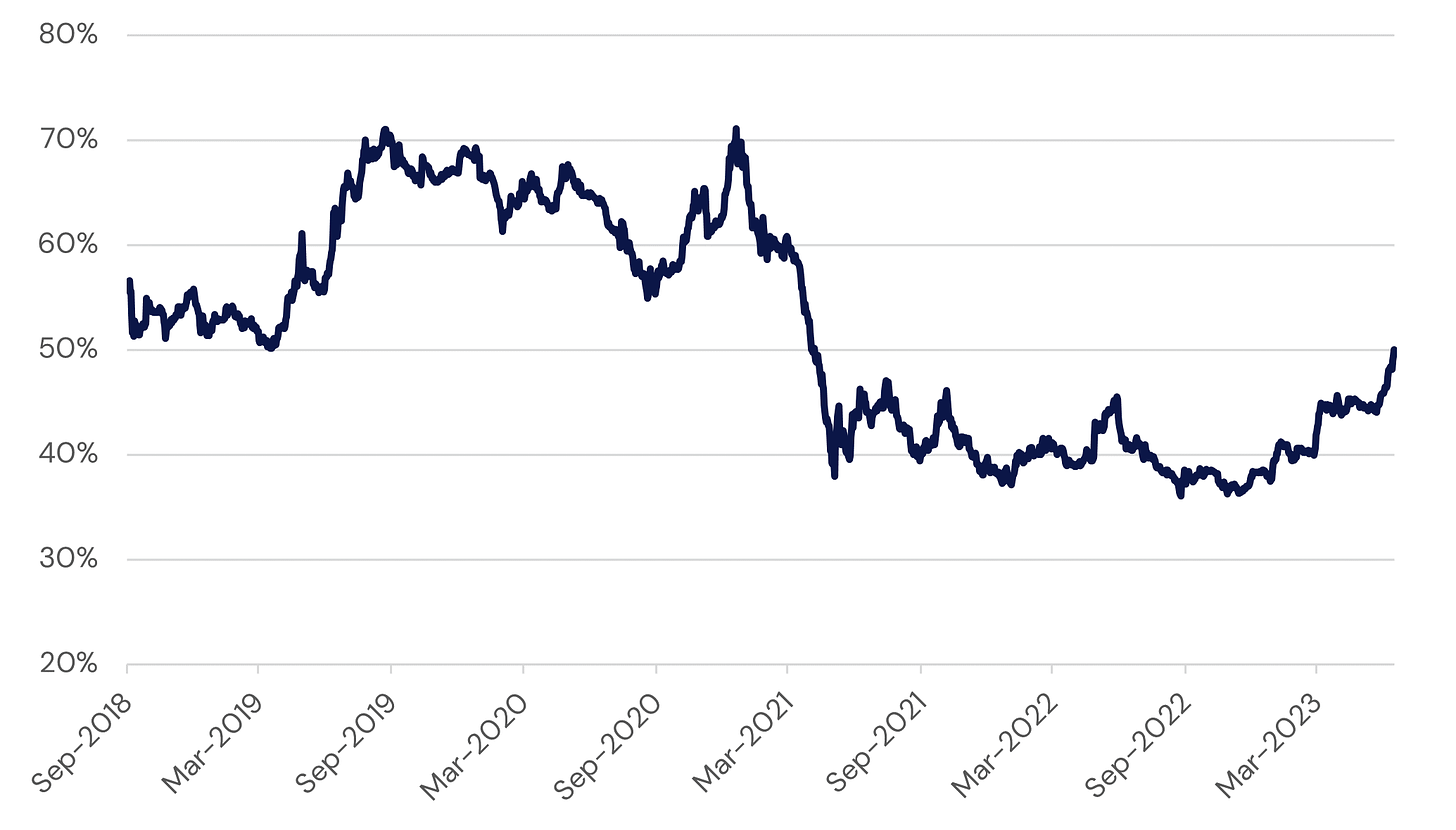

Bitcoin has been winning considerable mindshare lately. For most of 2022 and the early months of 2023, it seemed that the implications of “the burn”, the pivot to proof-of-stake, yield generation, and then enablement of withdrawals of staked ETH meant that Ethereum was most frequently highlighted in the news. There was a compelling case to be made that these new features could make ETH the digital asset of choice for institutional investors. However, it must be emphasized that “Bitcoin isn’t a security which makes it the only digital asset option for many.” Amidst a regulatory crackdown and banking crisis, BTC has emerged as a safe haven. The result is that Bitcoin dominance has recently broken out of a multi-year range to the upside.

BTC Share of Total Crypto Market Capitalization

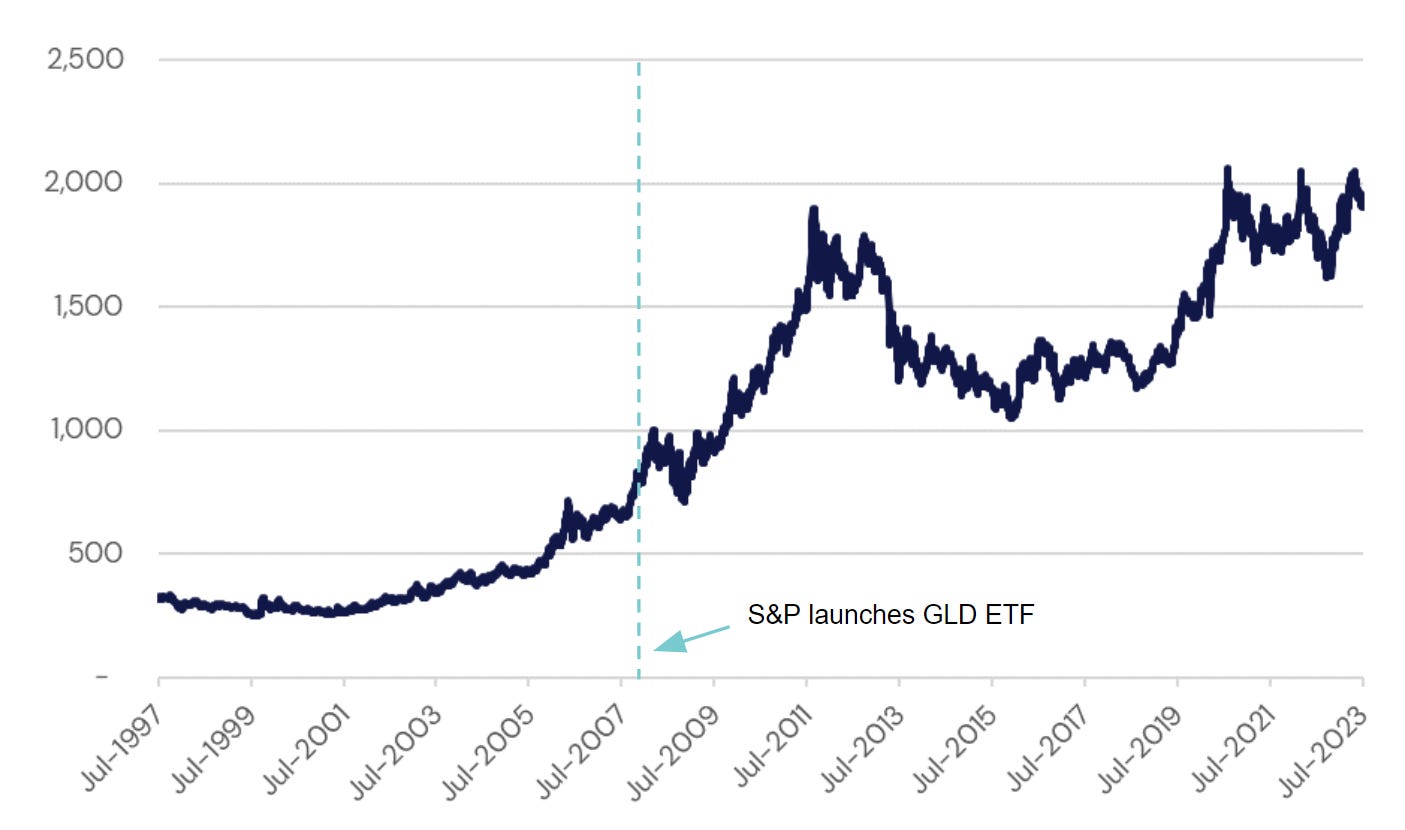

Outside of an attempt to increase taxes on miners, it seems BTC is relatively insulated from heavy-handed oversight and even the IMF has remarked that banning crypto assets “may not be effective in the long run.” The recent action of out the SEC has driven this point home too and, if anything, has provided clarity to traditional financial operators as it relates to offering BTC-linked products. There’s been a wave of applications for spot Bitcoin ETFs filed in recent weeks (with subsequent refilings to address gaps in the initial disclosure). The market has responded very positively, believing that easier access to Bitcoin will unlock considerable demand, as was observed when S&P’s gold-linked ETF (GLD) launched.

Gold Price ($/Oz.)

A successful launch of a spot ETF (or many) could have profound influence on the technical participants of the Bitcoin community, like developers and miners. The immediate potential effect is likely to be an increase in transaction volumes, which could cause network congestion and higher transaction fees.* This would further necessitate scaling (and user experience) innovations like enhancements to the Lightning Network. Broader acceptance of cryptoassets through educational or lobbying efforts of fund sponsors might remove barriers that previously deterred would-be miners or developers as well.

*Note: Aquanow has developed a proprietary BTC Fee Forecaster, which can help your business save time and/or money if you transact on-chain. Let me know if you’re interested in learning more.

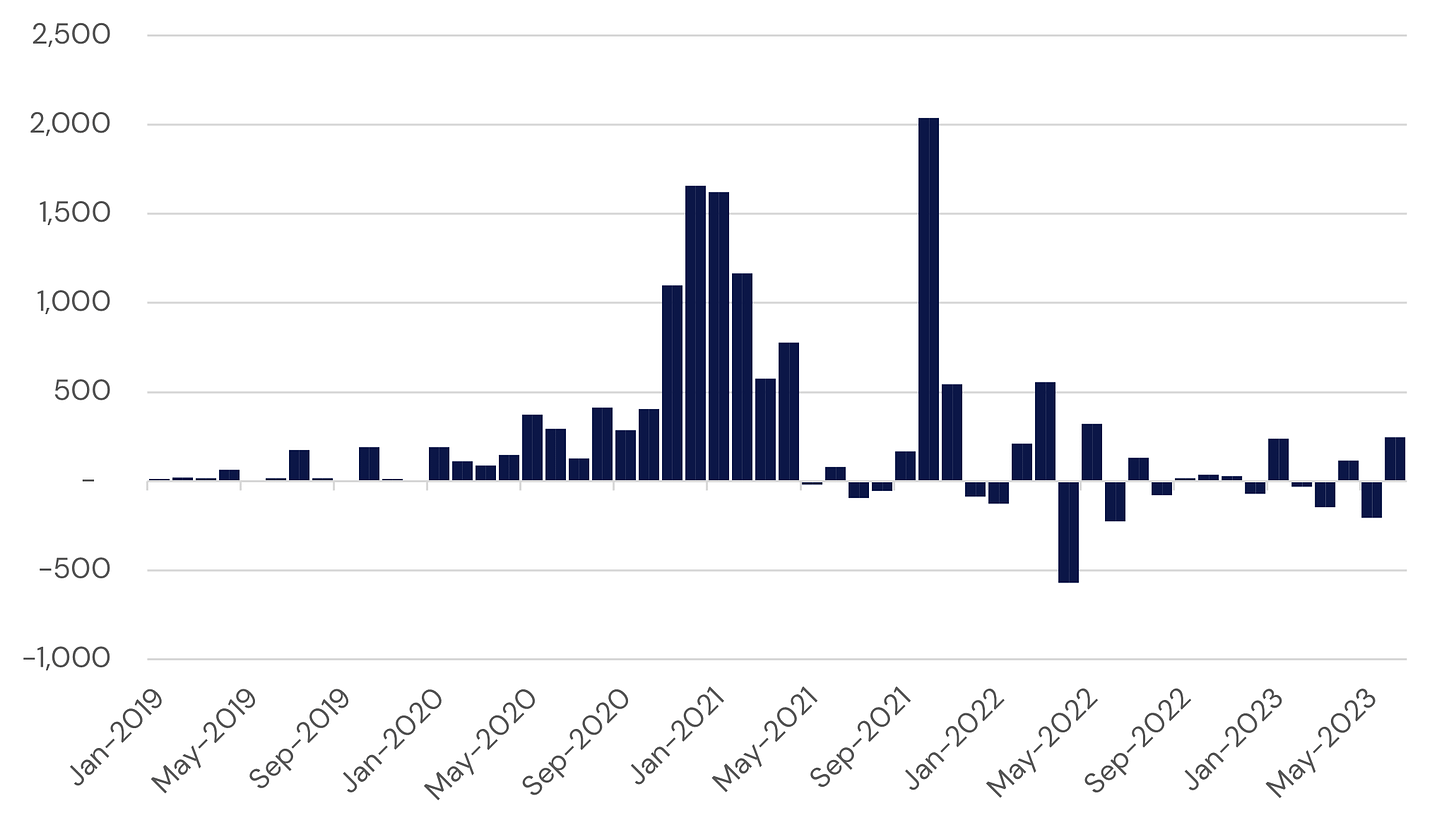

A spot ETF would have substantial implications for the investment and business community, too. For starters, such a vehicle could provide a more straightforward avenue for investors, especially institutional ones, to gain Bitcoin exposure. Many investment policy statements preclude the direct ownership of commodities, eliminating participation of the hard asset altogether. Outside of the bull market, the exchange-traded products available to market participants have proven unpopular.

Bitcoin Listed Funds Flow (in millions, USD)

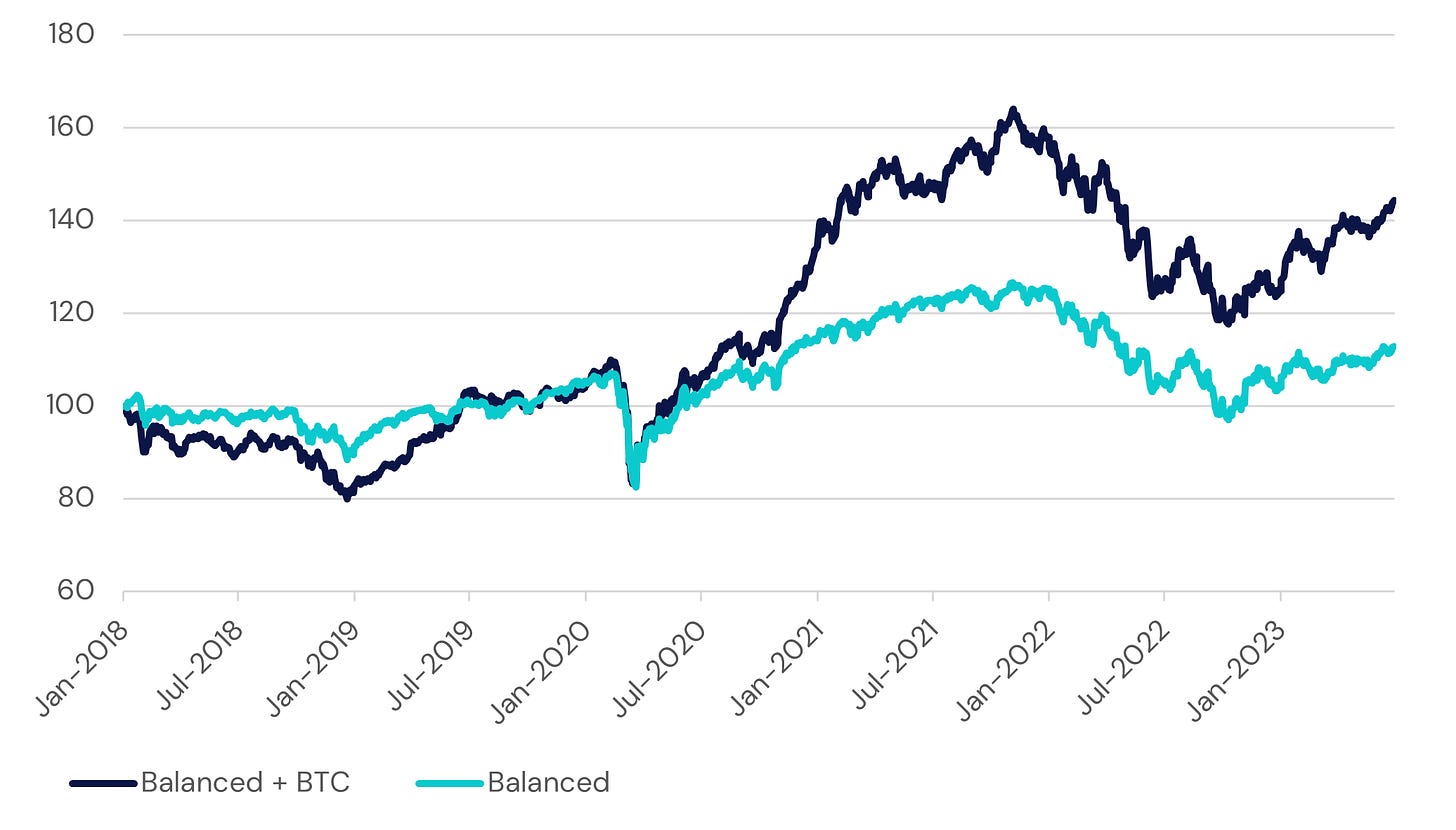

This could be the effect of cyclicality, but I’m not convinced. The portfolio math associated with adding BTC directly into a traditional 60/40 portfolio with regular rebalancing is very compelling. To drive the point home, below we present the difference in performance between the classic balanced fund (as represented by the iShares Core Growth Allocation ETF [AOR]) and that same fund supplemented with a 10% allocation to Bitcoin.

Relative Performance of Balanced Portfolio With and Without BTC

The crypto-enhanced portfolio produces a compound annual return of 6.9% versus 2.2% for AOR alone. So why then has there been limited interested in the current listed funds? Part of the problem stems from the usual issues in digital assets such as nascency, volatility, and bad press. Even still, the available vehicles today have demonstrated some product-market fit. Bloomberg notes that the total AUM of listed crypto funds exceeds $35B, but that’s less than 5% of just the single leading S&P 500 fund’s assets. Two of the more popular Bitcoin U.S. listings are Grayscale’s GBTC and ProShares’ BITO. The former is a closed-end fund, which due to a myriad of circumstances, has traded at a substantial discount to its asset value, while paying fees on the larger figure. The latter is futures-based, which can cause problems when markets are in contango, and the fund incurs significant costs to roll contracts. You can see an example below.

Relative Performance of BTC vs BITO

BITO investors might be shocked when they see their June statements. Spot BTC finished the month on strong footing, but due to the characteristics of the futures market, holders of the ETF actually incurred negative performance in the later weeks. Over the life of the fund, BITO has underperformed Bitcoin by nearly 25% and has lagged the digital asset by over 15% this year alone. Professional investors and advocacy groups are aware of these shortcomings, which ultimately serve as important arguments for a spot ETF.

In smaller markets like Canada and Sweden, there have been direct-access funds available for years. Those vehicles experienced strong inflows during bull markets, but performance and assets languished when the cycled turned. What makes the Blackrock (BLK) filing different? As we’ve discussed previously, public blockchains are underpinned by network effects (now the most dominant of which has a regulatory moat, too). If the world’s largest asset manager says that they’re a believer in Bitcoin, then this goes a long way to de-risk its ownership (beyond the technical ease of holding a stock over a digital asset).

I’ve spent the past few days at conferences specifically targeted to Bitcoiners and throughout the halls there’s a push to onboard more users. When BLK and others launch spot BTC funds, their collective strategies will further promote adoption through education, lobbying for favorable regulation, user-friendly platform development, security assurance, etc. These efforts are likely to introduce Bitcoin to a broader audience, which will increase its value, resulting in evermore adoption and so on. The benefits will spill over to other groups like businesses involved in the ETF's creation/redemption and surveilance, as well. Another interesting development to watch is how the Bitcoin community responds to a wave of newcomers who don’t hold decentralization and permissionlessness as core values. Bitcoiners are a tight-knit group, but they’ve tended to fracture over change in the past.

Bringing it all together, we can see that the new rush of applications for the launch of spot ₿ ETFs could catalyze a major milestone for Bitcoin and the wider cryptocurrency market. We’ll have to wait and see if they’re successful, but Blackrock is 575-1 when it comes to ETF applications and there appears to be political pressure to provide investors access to better tools, so it does feel like we’ll have a U.S.-listed product soon. I’ll be keenly awaiting the rise of institutional adoption thereafter.

At Aquanow, we help institutions unlock the potential of digital assets, so if you or anyone you know are considering this functionality, then please get in touch. We’d be glad to leverage our expertise to help you outperform.

If you want to contribute to the web3 movement, Aquanow is on the look for curious and motivated folks to join our team. Feel free to reach out directly or check out the current openings here.