Mobile Money, Global Rails

How stablecoins and mobile-first economies are shaping the future of financial inclusion and global payments.

Stablecoins are quietly revolutionizing global finance and they’re starting in the places that need it most. While many in the developed world remain focused on crypto speculation, millions in emerging markets are using stablecoins to send money, preserve value, and access the global economy. With over $250 billion in circulating supply and nearly $250 trillion in lifetime settlement volume, stablecoins have evolved from niche instruments into a core component of the modern financial stack.

But the story goes well beyond raw numbers. Stablecoins are emerging as foundational infrastructure for faster, cheaper, and more transparent payments—used by institutions, merchants, and millions of individuals alike. While their roots lie in crypto, their trajectory is being shaped by real-world utility: from remittances and savings to treasury operations and card payments.

In this edition of Aquanow’s Digital Dives, we explore how stablecoins are extending dollar access to new geographies, complementing mobile money in emerging markets, and becoming deeply embedded in everyday financial activity. What started as a blockchain experiment is fast becoming a global settlement layer—one that’s programmable, interoperable, and surprisingly practical.

A Rail, Not a Bet

Stablecoins are built for utility, increasingly functioning more like money market funds housed inside a chequing account—liquid, transparent, and programmable. Their economics center on three key advantages: speed, cost, and reliability. Transactions of any size settle in minutes rather than days, fees remain a fraction of traditional alternatives, and operations continue 24/7 without banking holidays or cut-off times.

This utility translates to real revenue. Stablecoin issuers now generate over $600 million in monthly on-chain income from their operations, primarily through interest earned on reserves and transaction fees. As institutional adoption grows alongside consumer usage, these numbers continue to climb. Major financial institutions increasingly view stablecoins not as a competitive threat but as infrastructure they can leverage for their own services.

The ecosystem supporting this growth is becoming increasingly robust, too. Major payment processors, banks, and even central banks are exploring or implementing stablecoin capabilities, recognizing their potential to streamline settlement processes and reduce operational friction.

The Dollar Dominates—for Now

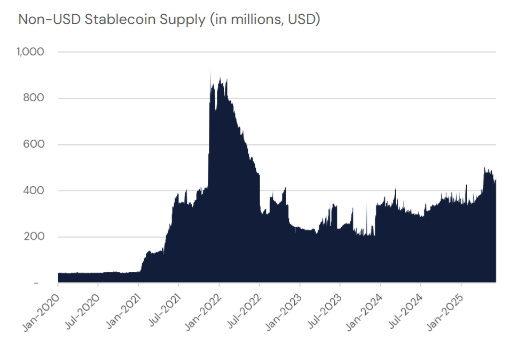

Nearly 99% of stablecoin supply is dollar-denominated. Despite experiments with euro-, real-, or yen-linked variants, none have come close to challenging USD-backed assets like USDT and USDC. This reflects a global preference for dollar liquidity, the relative stability of the U.S. financial system, and the broad acceptance of USD as a medium of exchange.

Yet that dominance may not last forever. Policymakers from Europe to Asia are crafting frameworks aimed at supporting localized alternatives. The European Central Bank's Digital Euro project and China's e-CNY represent significant attempts to create alternatives to dollar-based stablecoins, but may not offer the same level of composability. For now, stablecoins remain a dollarized technology with global utility. They extend the reach of the U.S. financial system far beyond traditional banking channels.

This dollar dominance also creates unique considerations. As U.S. policymakers grapple with stablecoin oversight, they're effectively shaping a global financial rail that extends American monetary influence while potentially creating new systemic risks. U.S. Treasury Secretary Scott Bessent recently remarked that he thinks stablecoins could grow to $2 trillion and he’s generally been positive about the prospect of these digital assets. One likely reason: stablecoins expand international demand for U.S. Treasuries, offering foreign users exposure to dollar-denominated assets. That’s particularly meaningful for a country managing $27 trillion in debt. It appears that policymakers stateside understand this opportunity.

Why Emerging Markets Lead

Blockchain technology and some intrepid innovators have made it easier than ever to access globally interoperable digital dollars—instantly and affordably. Some of the most dynamic stablecoin adoption is evident not in developed markets, but in places like Nigeria, Brazil, and Indonesia. In these regions, stablecoins are being embraced not as speculative assets, but as practical tools for savings, payments, and everyday transactions.

A recent report by Visa, Brevan Howard, and Castle Island Ventures shows that, across five emerging markets, stablecoin users are increasingly focused on non-crypto goals: saving in dollars, accessing better FX rates, earning yield, and making payments. Nigeria, in particular, stands out. There, users hold a larger share of their financial portfolio in digital dollars than anywhere else surveyed.

Perhaps most revealing: stablecoin transaction volume significantly exceeds Bitcoin usage in MENA and Sub-Saharan Africa. This trend reflects a shift from speculative use cases toward practical applications—where stablecoins are serving as efficient, accessible tools for moving value across borders and between individuals. They’re exciting complements to existing financial channels!

This adoption pattern follows a familiar trajectory in financial innovation—the greatest uptake occurs not where existing systems work reasonably well, but where they fail to meet fundamental needs. Just as mobile payments leapfrogged card infrastructure in parts of Africa and Asia, stablecoins are laying new foundations for financial services in regions that stand to benefit most.

Mobile Is the Foundation

Mobile is already the dominant financial interface in many emerging markets. In Sub-Saharan Africa, smartphone penetration has doubled since 2017, now exceeding 60%, with continued growth expected. Mobile money services already contribute between 2–8% of GDP in several economies.

Blockchain-based dollars build naturally on this momentum. A mobile app that supports stablecoins doesn't just connect users to local payment networks, it links them to a global financial system. For users already transacting via wallets and QR codes, stablecoins are a logical next step.

The convergence of mobile penetration, digital literacy, and crypto accessibility creates a powerful foundation for financial inclusion. In regions where banking penetration remains below 30%, the combination of smartphones and self-custody wallets offers a pathway to financial services accessibility.

Beyond Remittances: A Broader Payment Stack

Remittances are perhaps the most visible stablecoin success story—offering a faster, lower-cost alternative to traditional corridors. But they're just the beginning.

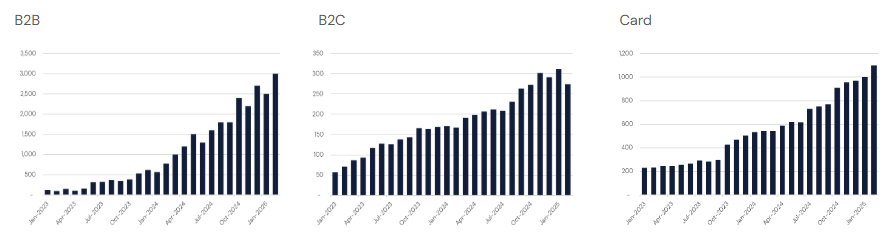

Artemis' on-chain analytics show explosive growth across B2B, B2C, and crypto card-based stablecoin transactions:

B2B volumes are up 25x since early 2023

B2C transfers and crypto-linked card payments have grown more than 5x and 6x respectively

P2P flows, already strong, continue to process ~$1.5B/month consistently

Together, these trends suggest stablecoins aren’t just improving remittances—they’re becoming the connective tissue of next-generation commerce. It may be less obvious if you're in a developed market or not paying close attention, but from treasury operations to merchant settlements to consumer transactions, stablecoins are steadily weaving into the fabric of the global financial system

This expansion is enabled by growing interoperability between traditional and blockchain-based systems. Payment giants now offer crypto settlement options; banks are building proprietary solutions on public blockchains; and e-commerce software providers are integrating stablecoin capabilities into their platforms. The boundaries between traditional finance and blockchain networks are becoming increasingly permeable.

From Frontier to Foundation

Stablecoins may have started as a crypto-native experiment, but they’ve grown into something far more consequential. Today, they’re starting to take the shape of a global settlement layer powering the next generation of financial services.

This is a story about utility. In regions like MENA and Sub-Saharan Africa, stablecoins are already helping people move money more efficiently and affordably. Remittances remain a key use case, but the applications extend further. Stablecoins are built for mobile, enabling better consumer experiences and opening new pathways to participate in the global economy.

The most transformative financial innovations tend to take hold where the need is greatest. It’s no surprise that digital dollars are gaining traction in places with limited access to traditional banking. This adoption isn’t driven by hype. It’s grounded in real-world utility and novel distribution through smartphones.

Now the focus shifts to integration. The organizations embedding stablecoins into trusted platforms—wallets, telecom networks, and everyday financial apps—will shape the next era of financial access. For incumbents, this is more than a challenge. It’s a chance to modernize infrastructure and expand into new markets. The result will be economies increasingly connected by internet pipes.

At Aquanow, we’re building for that future—working with partners to move digital assets from promising innovation to everyday infrastructure.