Aquanow Digital Dives: You Call That a Moat?

Hi all, you’ll notice that this email is coming to you in a slightly different format than usual. We’ve switched over to Substack because it’s a superior newsletter platform and we hope it will make your experience more enjoyable. There’s one little hiccup – the platform tries to monetize creators’ content, so please disregard any mention of payment or pledges. Aquanow’s Digital Dives is free for anyone who’s interested in the topics we cover.

In the previous two editions of Aquanow’s Digital Dives, we first discussed network effects in a general case and then narrowed the analysis to focus on how the phenomenon can be studied across Layer 1 blockchains. Now we’ll examine the creation and defence of economic moats of networked businesses through the lens of two prominent decentralized exchanges (DEXs) in DeFi: Uniswap (Uni) and SushiSwap (Sushi).

Warren Buffett popularized the term “moat” as a representation of a company’s durable competitive advantage in the 1986 Berkshire Hathaway Annual Letter and he discussed this metaphor during the 1999 Annual Meeting of BRK shareholders:

A company underpinned by network effects would have advantages over a simpler competitor (think Amazon vs. a mom-and-pop retailer), but this isn’t a sufficient condition for a moat in all markets. If the independent merchant has a better grasp of a certain group’s desires, then they might be able to provide a superior product or service. Perhaps they could use this foothold to eventually disrupt the incumbent, tapping into the same network effects. This is an example of cherry-picking, like what Airbnb did to Craigslist. You can read more about how new entrants disrupt incumbents here.

While a network effect can provide a competitive advantage, it is not always enough to create a lasting economic moat. This is particularly true in a space where technology makes it easy for competitors to mimic one another. Modern organizations must prioritize community relations and innovation to create and maintain distance from competitors along several vectors.

The concept of an Automated Market Maker (AMM) transformed the digital asset landscape and Uniswap’s implementation of the technology was a key catalyst for DeFi’s popularity today. We won’t spend time discussing the underlying math, but encourage curious readers to dig in here. The important takeaways are that by incentivizing the deposit of liquidity into asset pools, AMMs can provide an open and efficient way for anyone with a crypto wallet to trade fungible digital goods.

In May 2020, Uniswap launched an upgraded version of their AMM that provided more flexibility, curtailed risks, and reduced costs. The V2 implementation coincided with Compound’s incentive scheme which offered $COMP tokens to users engaged in borrowing and lending on the platform. This wasn’t the first instance of native tokens being used to incentivize users (liquidity mining), but it sparked a frenzy of activity as DeFi investors sought to earn $COMP while generating a return on other assets.

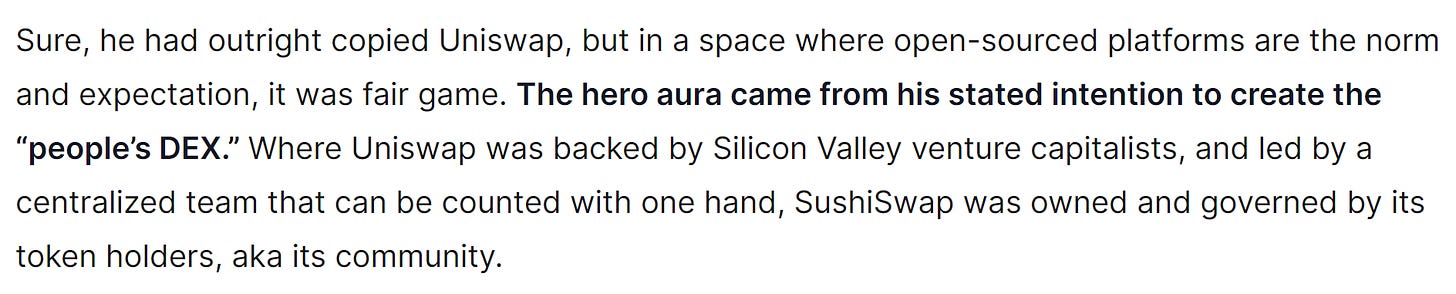

At the time, Uniswap was the dominant DEX, which meant they captured the largest share of on-chain trading and associated liquidity. However, the project was backed by venture capital, operated as a centralized group, and did not have a native token. These features were viewed as undesirable by many in DeFi. Then, in August 2020, a pseudonymous developer (Chef Nomi) forked Uniswap to create a new DEX. SushiSwap was effectively a clone of Uni’s V2, but with “community-oriented” features like a governance token ($SUSHI) for liquidity mining and staking rewards.

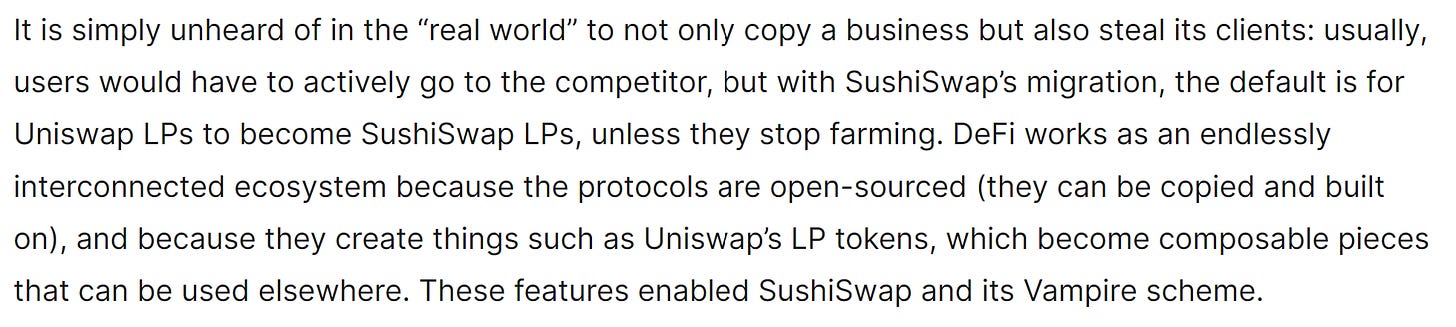

Community is integral to the digital asset ecosystem and it’s often the case that users feel entitled to some of a platform’s profits associated with their activity. Recognizing this, Chef Nomi identified an opportunity to leverage the network effects of a DEX and orchestrated a Vampire Attack on Uniswap. By paying users to migrate their liquidity away from V2, Sushi could bypass the cold start problem and bootstrap deposits to their venue. Staking rewards offered on $SUSHI tokens were meant to provide an incentive to hold, resulting in a virtuous cycle for token holders.

Then some drama unfolded. Chef Nomi unilaterally sold $13M of $SUSHI tokens from the Developer Fund for ETH (on Uniswap, of course…), which caused the governance token to shed over 70% of its value. More chaos followed, but the net effect was a severe undermining of SushiSwap’s position as “the people’s DEX”. Having said that, traders found the triple-digit yields offered by migrating to Sushi too good to refuse, so Sushi did temporarily take share.

Eventually the sustainability of liquidity mining was brought into question across all DeFi and now the tactic is used sparingly. Growing too quickly on the back of incentives can attract the wrong users. These folks aren’t there for the community or tech, so when the rewards cease, so does their engagement.

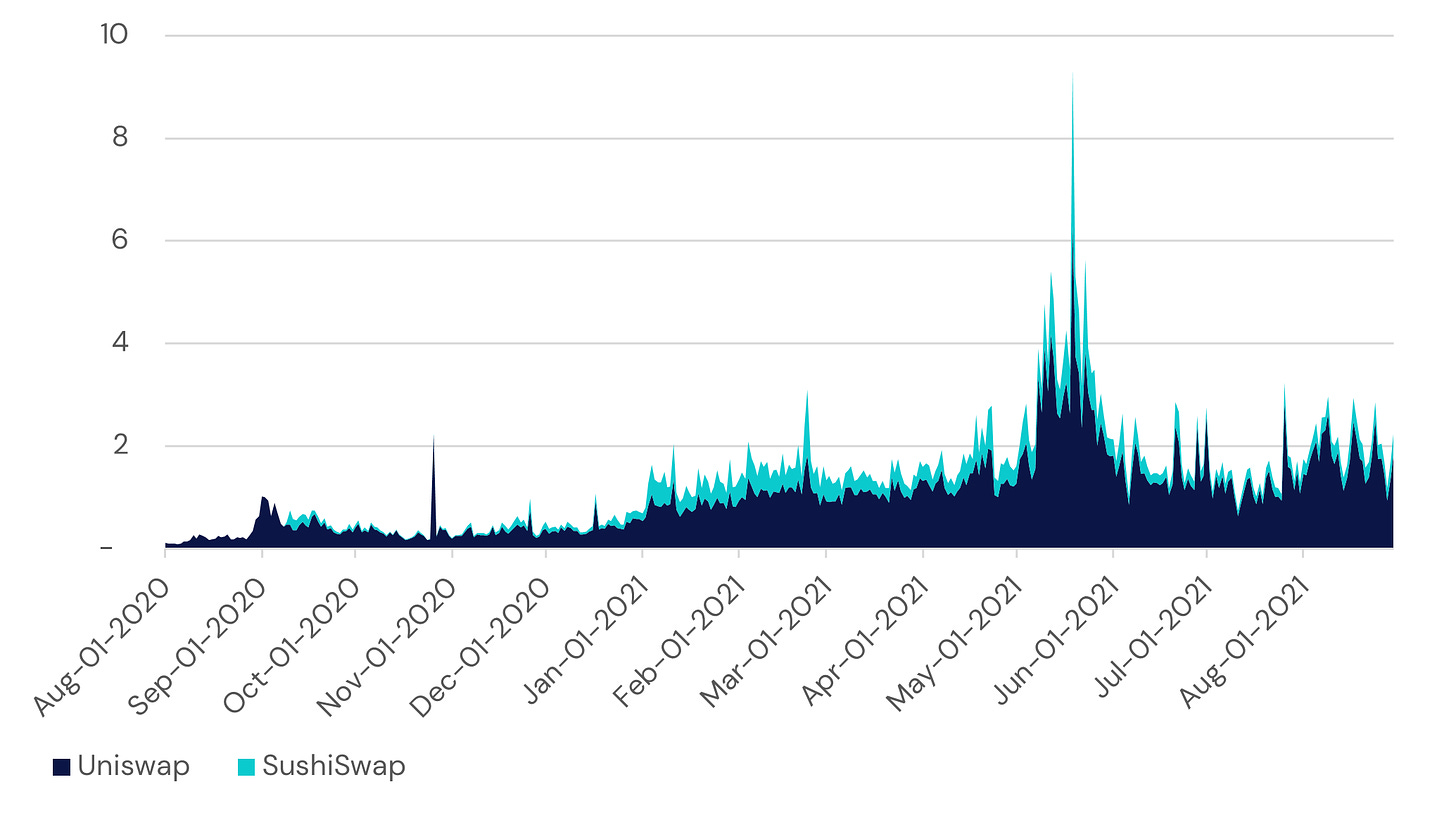

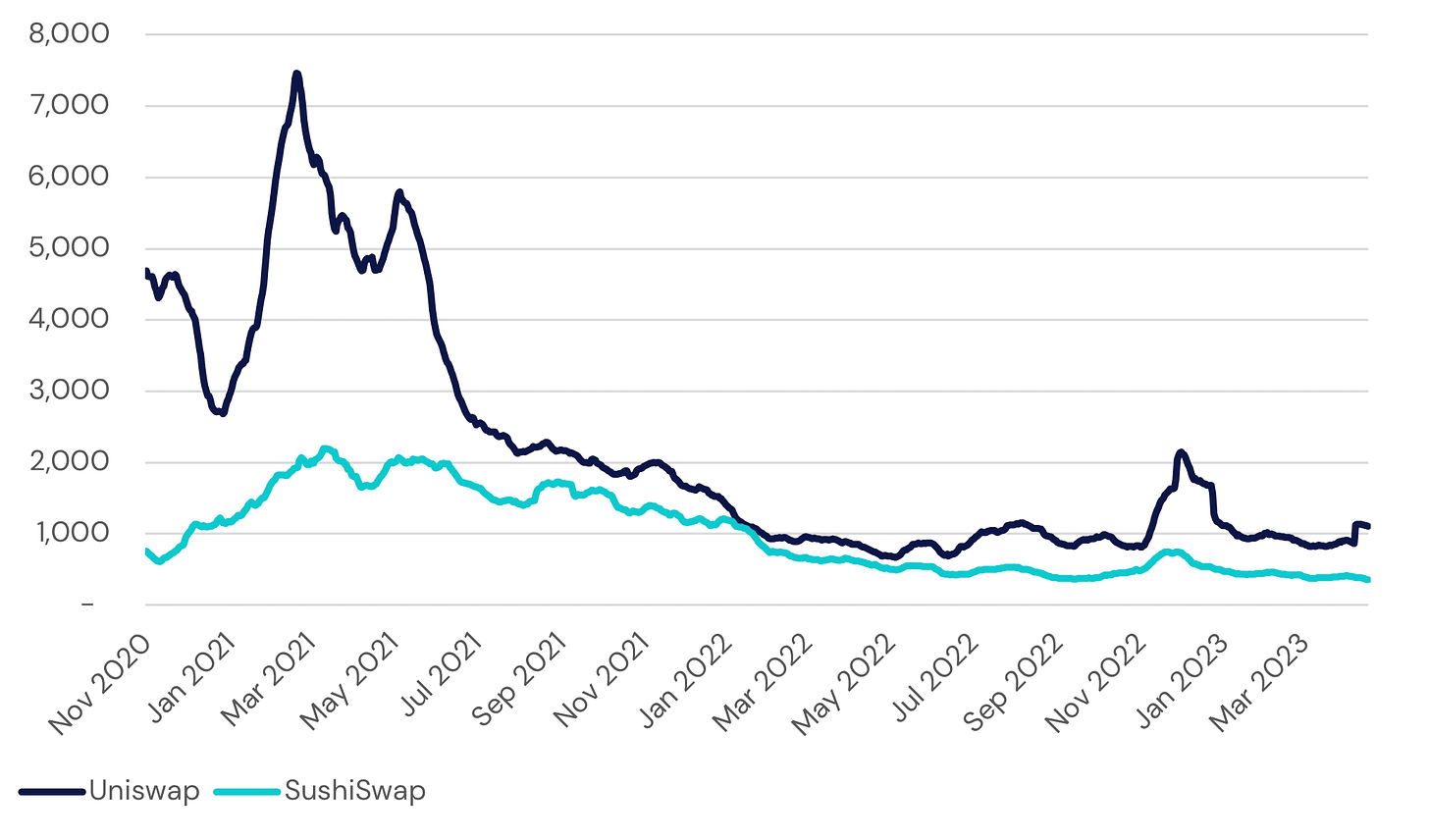

Relative Trading Volumes During the Vampire Attack (in billions, USD):

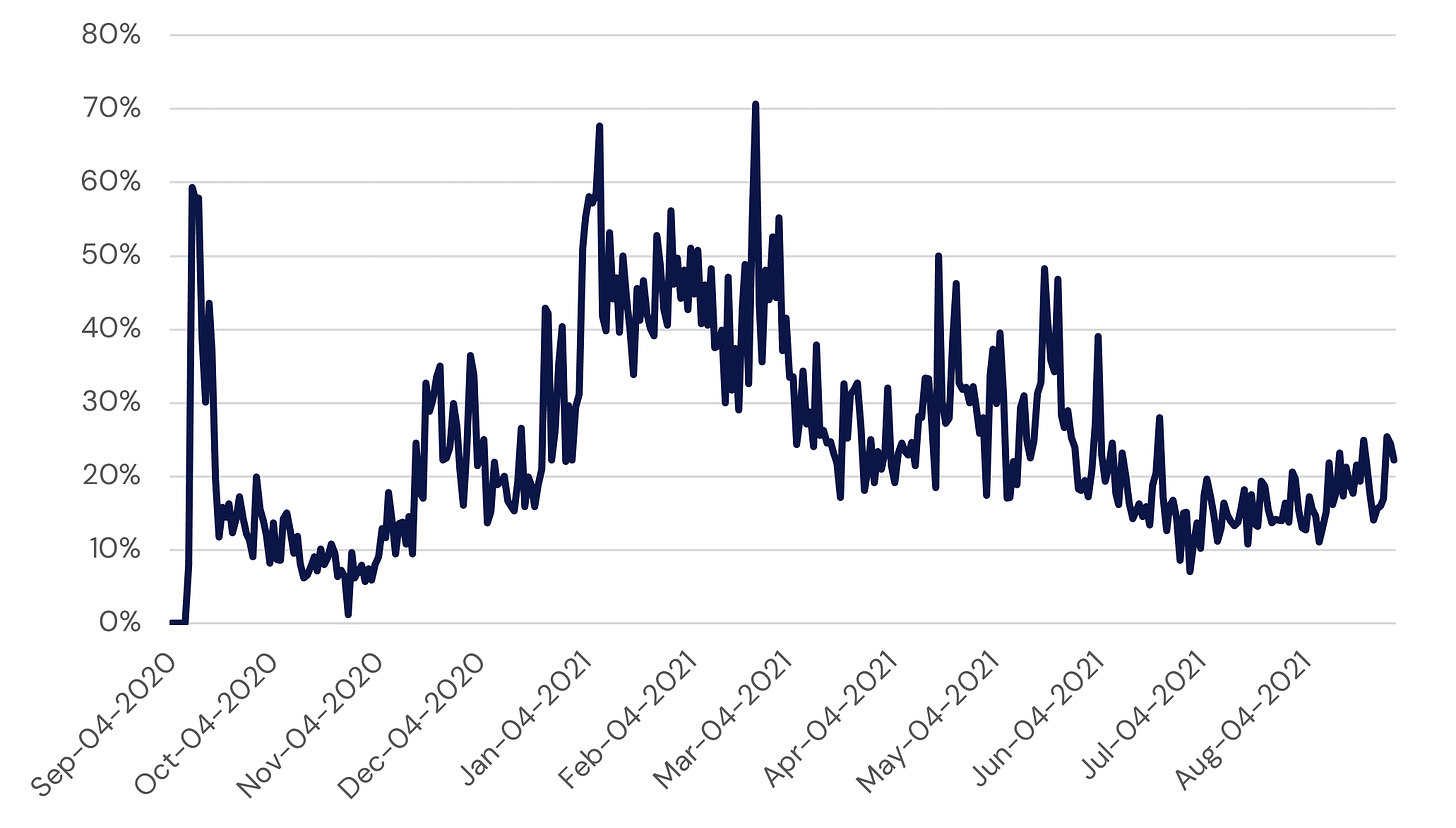

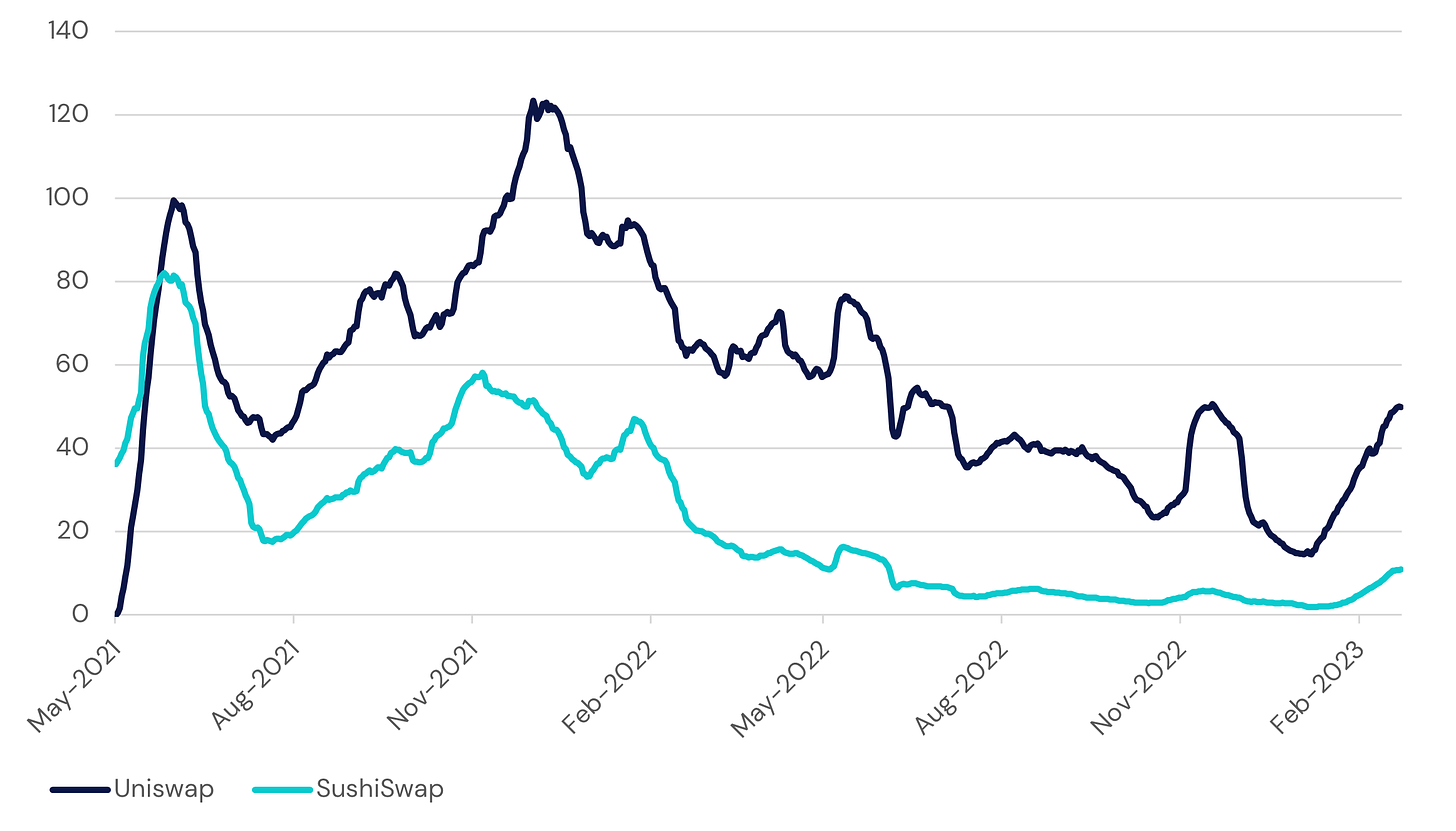

SushiSwap Volumes as a Percentage of Uniswap Volumes During the Vampire Attack:

SushiSwap’s strike against their competitor serves as a good example for why network effects aren’t in and of themselves a moat. Uniswap launched their own governance token ($UNI) in September 2020, and distributed the asset generously among users. This helped the protocol win back some good standing in the digital asset community.

Uni currently has more than 3x the Daily Active Users of Sushi:

A more powerful catalyst came when the team unveiled Uni V3, which promised to be “the most flexible and efficient AMM ever designed” with important enhancements to the user experience for traders and liquidity providers alike. Critically, the new deployment’s source code was protected against replication for commercial use for two years. Sushi continued to face governance headwinds and failed to ship any meaningful product improvements. A culture of customer-led innovation can serve as a durable competitive advantage. Legislation has moat potential as well. Engineering activity to advance Uni dominates Sushi.

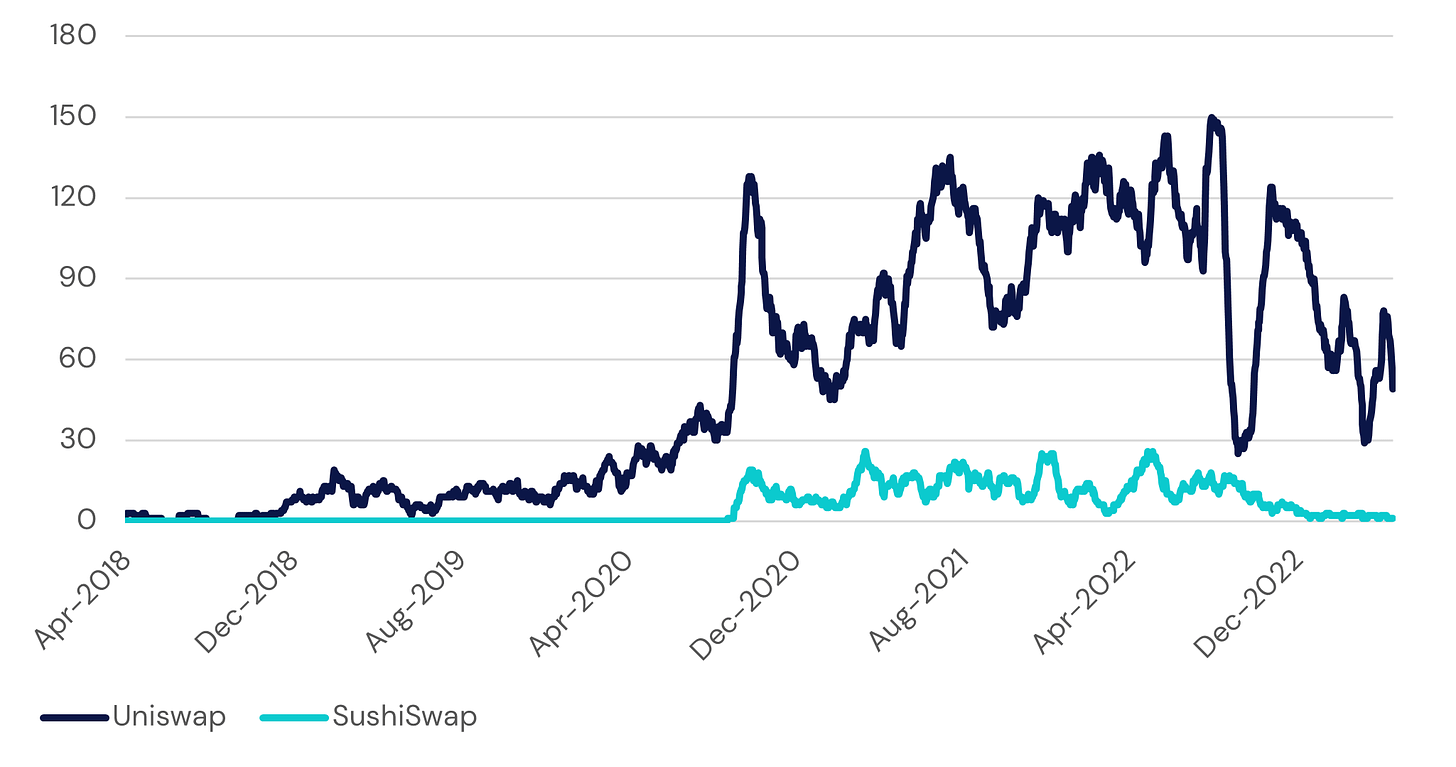

Core Developers:

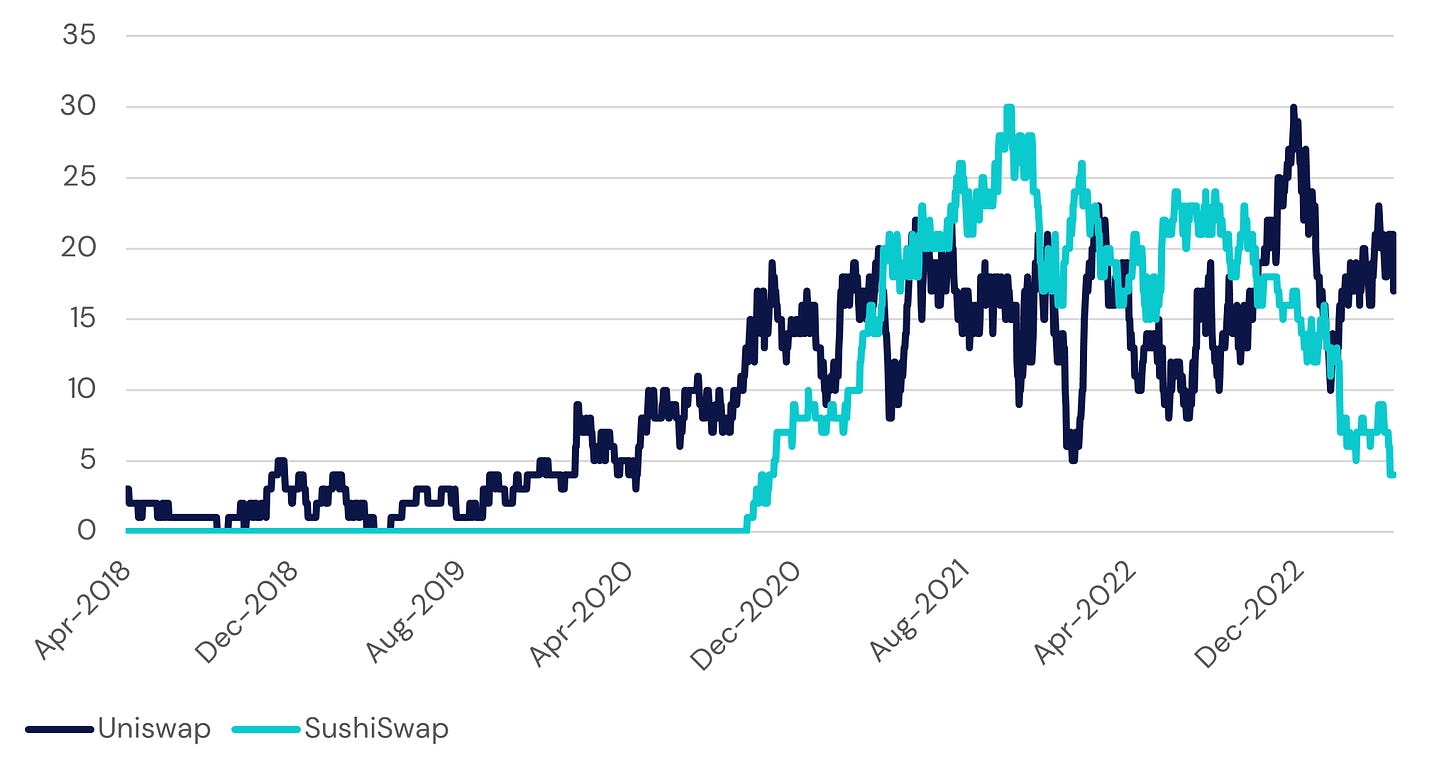

New Developers:

Despite their challenges, SushiSwap is still a top DEX in terms of trading volumes today. Maintaining market share is tough, so Uniswap cannot rest on its laurels, or it will open itself to potential disruption. To date, the economic rewards have accrued disproportionately to Uni, but Sushi should not be ignored, since they’ve managed to establish a community of dedicated users and have recently implemented changes to foster sustainability. Uni’s V3 has come off protection and Sushi has already announced plans to fork it. This should help them preserve market share and may even result in some wins on different chains. But, ultimately, copy/paste is not a sustainable business plan.

Total Value Locked (in billions, USD)

Trailing 28-day Revenue (in millions, USD)

Groups competing for attention and capital should continue to improve the user experience while rolling out innovations in response to community engagement. While initial reviews are mixed, Uniswap recently launched in Apple’s App Store, enabling mobile customers to trade tokens and NFTs in a decentralized venue. The Launch of Uni’s V3 on BNB Chain has shown promise, too. Given the numerous counterparty failures of 2022, many believe that DEX volumes will take share from their centralized counterparts. The interfaces would require meaningful improvements, but community-focused and innovative teams like Uniswap might have what it takes to build that future.

At Aquanow, we help institutions unlock the potential of digital markets, so if you or anyone you know are considering this functionality, then please get in touch. We’d be glad to leverage our expertise to help you outperform.

Do you want to contribute to the web3 movement? We're on the look for curious and motivated folks to join our team. Feel free to reach out directly or check out the current openings here.